Business owners: why NOT to dip into your retirement account

Things are tough in the age of coronavirus, but there are ways to make ends meet without touching your retirement account.

The COVID-19 pandemic is making its lasting mark on most of the world’s finances. And while businesses in certain industries have thrived, the majority of others have not been so fortunate. If your business has suffered as a result of the pandemic (and is likely also affecting your personal financial picture), you may be tempted to seek solutions that you normally wouldn't — like tapping into your 401(k) or retirement account to cover business expenses or inject cash flow. That may seem like a good idea, but please consider this to be your absolute last resort.

In the past, early withdrawal attempts from your retirement plan would have had major roadblocks — if you qualified, you would have paid a 10% penalty plus taxes on the funds withdrawn — but right now, a lot of those stipulations are temporarily postponed for qualified individuals. You may be considering an early withdrawal from your retirement account, but before you do, let's take a look at the long-term costs of that decision and some alternatives that may work for you.

In short, liquidating all or some of your retirement savings could cost you a LOT more down the road.

Keep compound earnings working for you

Compound earnings are the largest benefit of a retirement plan. Your contributions into your account earn interest with investments, and those earnings go right back into your account and are invested. The earlier you start investing, and the longer you wait to withdraw, the more compound earnings benefit your account.

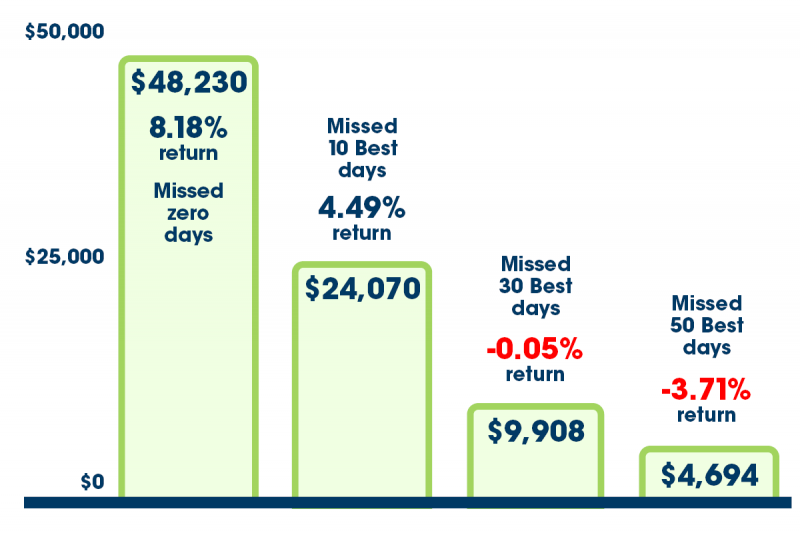

About those market ups and downs...

We can’t time the market, so investing over a long period of time allows for the ups and downs of the market to provide real strength to your portfolio. When the market is down, retirement investment costs remain low. When the market is high, you make money. Though investing is a risk venture, long-term investing is how your retirement account grows. Missing out on big market days could have a lasting effect on your account balance.

Why stay invested: S&P 500 Returns (example)

Performance of $10,000 investment between January 2, 1996 and December 31, 2015. Six of the 10 best days occurred within two weeks of the 10 worst days.

This chart is for illustrative purposes only and does not represent the performance of any investment or group of investments.

Plan to stay invested

Trying to time the market is extremely difficult to do consistently. Market lows often result in emotional decision making. Investing for the long term while managing volatility can result in a better retirement outcome.

What to do instead

Though dipping into your retirement savings may feel like an easy way for you or your employees to cover expenses, here are some other options to consider.

- Cut spending — reduce your expenses as much as you can by re-evaluating your business budget’s needs vs. wants. Cutting expenses now allows for savings later.

- Grow revenue (creatively) — what can your business do or offer that's in demand as a result of the pandemic? Get creative and adjust your business model to take advantage of anything you can: your location, spin-off products, and your staff's talents. You never know, this could be the next big thing for your business's future.

- Talk with your landlord — try to negotiate lower rent, even if it's only for a limited time. We've all gained a greater understanding of the challenges we face, and it's in all our best interests to keep the doors open.

- Talk with suppliers — find out what options you have to spread out your costs. Chances are they may already have options in place, or will be understanding, as it’s in their interest to keep your business.

- Contact utility companies — see if they are offering financial assistance or payment deferrals for businesses.

- Think digital — can you digitize any of your products or services and start offering them online? Can you implement technology to balance any loss of earnings by offering a new way to connect with your customers?

Personal finance moves that may help:

- Explore refinancing your current home loan to reduce monthly payments.

- Look into delaying or deferring car payments or refinancing your current auto loan to a lower monthly payment.

- Check with your credit card provider about delaying or changing your current credit card payments or shop around for a balance transfer deal on a lower-interest card.

- Do you have student loans? Currently, federal school loans are not requiring payment. If you are able to pay them, you can, but payment is delayed until at least January 1, 2021.

- Check with your trusted banker or financial advisor for other options based on your current financial picture and business strategy.

It’s hard to tell what the long-term financial impact of this pandemic will be, but no matter what, UBT’s team of business banking, commercial lending, and wealth management experts are here to help you navigate the ups and downs. If you have questions, don’t hesitate to reach out — because at UBT, your money has people (and so do you).

|