Frequently Asked Questions

Some tips for protecting your personal information:

- Be cautious when providing personal data such as your Social Security Number and bank account or credit card account information over the telephone, in person or on the Internet. Do not give out this information unless you are sure of the person with whom you are dealing.

- Carry only necessary identification with you. Do not carry your – or other family members' – Social Security card(s). Do not carry passports or birth certificates unless needed that day.

- Monitor bills and bank statements frequently and immediately report any suspected fraudulent transactions to the holder of your account.

- Receive and store as many of your account statements electronically as you can.

- Store cancelled checks, new checks and account statements in a safe place.

- Question suspicious emails. We will never send you an email asking for your online ID or pass code.

- Install anti-virus and anti-spyware programs on your home computer. Keep these programs updated.

- Don't write your personal identification number (PIN), Social Security Number, driver's license number or credit card account number on checks, or on your ATM, credit card or debit card. Stand directly in front of the ATM when entering your PIN.

- Keep mail secure. Do not mail bills or sensitive information from your home or unsecured mailboxes. Retrieve and review your mail promptly.

- Tear up or shred pre-approved credit offers, receipts (including ATM receipts) and other information that could link your name to your account numbers.

- Check your credit report periodically and be sure all information is up to date and accurate. Have any fraudulent transaction deleted. For a free annual copy of your credit bureau report contact www.annualcreditreport.com or call 1-877-322-8228.

Great question! At UBT, we’re doing all we can to keep your data safe, but you can do a lot on your own keep your account information secure. Here are ways to protect yourself against cybercrimes and fraud.

- Make sure your password is strong with a combination of words, numbers, and symbols that is easy to remember but hard to guess. Using a unique username and password (not just a strong password) for your banking account is critical security and best practice.

- Be leery of emails you weren’t expecting even if they appear to come from someone you know, and never open attachments or click on hyperlinks in these emails.

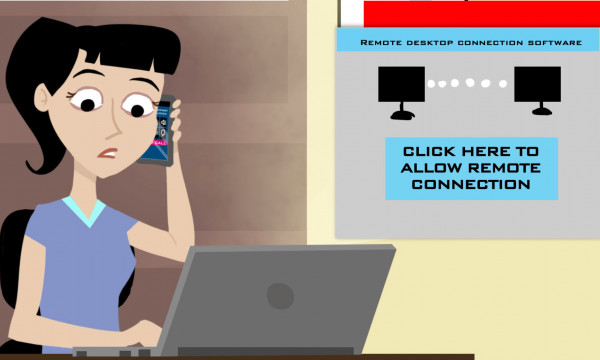

- Remember that no UBT employee or any other bank or IT professional will ever call, text, or email you to ask for your password.

- Don’t trust unsolicited phone calls or emails asking for payment or personal information.

- Don’t share or provide a password over the phone or through a link you receive in an email.

- Don’t click on links or attachments sent by people you do not know through social media messaging apps.

We want to assure you that UBT has a team devoted to cybersecurity whose job it is to monitor for potential threats and vulnerabilities. They have extensive technical controls in place to protect our networks and data — including your information.

When you add extra security to your computer, a secure cookie will be placed on your computer. This secure cookie is unique, and when used in combination with your login information, creates a unique way to identify you to the system. For every login attempt after you add extra security to one computer, this secure cookie is validated along with the login identification you normally enter. This secure cookie is only used by Union Bank & Trust to validate your identity and does not contain any personal information.

When locked, the padlock icon on your internet browser (Internet Explorer, Google Chrome, Firefox, Safari, etc.) indicates the console is running in secure mode. In this case, communications between the client platform running the console and the managed computer are encrypted using SSL. The padlock icon is open when secure communications are not active.

The location of the padlock can vary by web browser, but is typically located on either the left or the right end of the field where the url (web address) is listed.

You may also confirm you are on a secure site (like Union Bank's web site) when the url (web address) for the page you are on begins with "https://"

When using the internet, there are several ways to protect your accounts and personal information, including:

- Memorize your Username and Password. Do not store them in documents that can be accessed through your computer unless those documents can be password protected.

- Do not use easily verifiable information, such as birth dates, social security numbers and addresses when creating usernames or passwords.

- Frequently change your password. You can change your UBTgo password when you're logged in by clicking Profile > Profile Updates > Change Password.

- Completely sign off after each online session

- Be aware of potential online scams - many scam websites will ask you to provide account information for you to receive "free trials" of products or services, which they then charge you for.

If you ever have doubts about the website you are visiting, simply call the company that runs the website and ask questions. Most legitimate companies will have no problem speaking with a potential customer about security and online safety.

Need Support?

Connect with our people online

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.