Get more out of your money

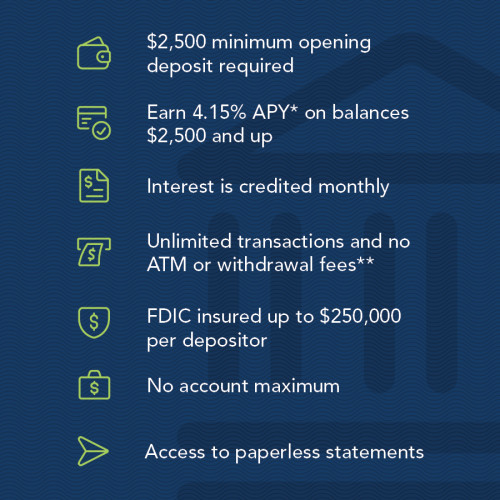

This high-yield online Direct Money Market account from Union Bank & Trust offers you a premium interest rate — 4.15% APY* on balances $2,500 and up — plus the flexibility to access your funds when you need them. It combines the liquidity of a checking account with the rates of a savings account. With unlimited transactions and no withdrawal fees, you don’t have to lock away your funds, and there are several ways to access and move your money.

Why UBT?

100+ years of banking excellence — right at your fingertips

Union Bank & Trust combines over a century of trusted financial expertise with seamless digital convenience. We’re committed to helping you strengthen your financial position with confidence, offering high-yield accounts, FDIC-insured accounts, and secure, easy-to-use tools accessible wherever you are.

With our highly rated UBTgo app† (4.9 stars) and real-person customer support, managing your money has never been easier. Union Bank & Trust, a privately owned bank in Lincoln, Nebraska, holds $8.8 billion in bank assets and $42.7 billion in trust assets as of June 30, 2025.

†Message and data rates may apply

Frequently asked questions

What is a money market? This account is a high-yield checking account that acts like a savings account. You can earn premium interest while enjoying the flexibility to access your funds via your Union Bank debit card, account-to-account transfers, or through Zelle®. See more here.

Which states are eligible to open a Direct Money Market? The product is currently available in Arizona, Colorado, Iowa, Kansas, Missouri, South Dakota, and Wyoming.

What are the benefits of a money market? You can get a high rate while having access to your money without locking away your funds. When you need spending flexibility but are focused primarily on savings, a money market account can give you some benefits of both savings and checking accounts.

What’s the difference between a money market and a traditional savings account? You can earn interest on both savings accounts and money markets, but this Direct Money Market account offers you a debit card for easy account access as well as unlimited transactions and no withdrawal fees. Money markets offer more flexibility and usually come with a higher rate than most savings products.

How many transactions can I do a month? Unlimited. While other banks may charge fees for excess withdrawals, we do not.

What is APY? APY stands for annual percentage yield, which is defined as the percentage rate for the total amount of interest paid on an account based on the interest rate and frequency of compounding for a 365-day period — or in layman’s terms, the percentage rate of how much interest you earn in one year. Higher APY = more earnings!

How often is interest paid on this account? Interest compounds daily and is credited monthly — meaning the longer you leave your money in the account, the more that interest will compound, so there is a lot of earning potential.

Direct Money Market

Every day you wait is another day you’re missing out on compounding interest. Put your money to work by opening a Direct Money Market account today.

*The Annual Percentage Yield (APY) is accurate as of 12/16/2025. Rates subject to change at any time. Minimum daily balance of $2,500 must be maintained to earn interest. $2,500 opening deposit required. This Direct Money Market and APY disclosed is only available in select states: AZ, CO, IA, KS, MO, SD, WY. Fees may reduce earnings.

**ATM usage fee at non-Union Bank ATMs waived. Non-UBT ATM owners may apply an ATM surcharge fee on transactions at their ATMs. Up to $20 in ATM surcharge fees will be waived per statement cycle.