An account that maximizes your returns

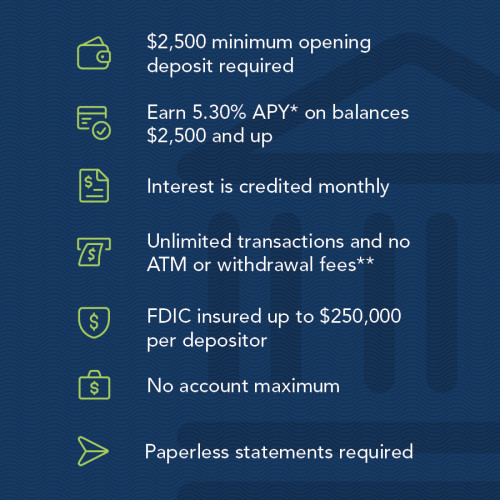

This high-yield money market account from Union Bank & Trust offers you a premium interest rate — 5.30% APY* on balances $2,500 and up — plus the flexibility to access your funds when you need them. It combines the liquidity of a checking account with the rates of a savings account. With unlimited transactions and no withdrawal fees, you don’t have to lock away your funds, and there are several ways to access and move your money. Opening your account online is simple and takes as little as three minutes.

Why UBT?

Big-bank service with Midwestern roots

Union Bank & Trust is a privately owned Midwestern bank based in Lincoln, Nebraska, that offers complete banking, lending, investment, and trust services. It is the third-largest privately owned bank in Nebraska, with bank assets of $8.5 billion and trust assets of $51.1 billion as of July 24, 2024. When you save with Union Bank & Trust you can rest assured that your savings is FDIC insured and when you need us, a real person will be on the other end of the phone (or chat window!) to answer your questions and assist you.

Frequently asked questions

What is a money market? This account is a high-yield checking account that acts like a savings account. You can earn premium interest while enjoying the flexibility to access your funds via your Union Bank debit card, account-to-account transfers, or through Zelle®. See more here.

What are the benefits of a money market? You can get a high rate while having access to your money without locking away your funds. When you need spending flexibility but are focused primarily on savings, a money market account can give you some benefits of both savings and checking accounts.

What’s the difference between a money market and a traditional savings account? You can earn interest on both savings accounts and money markets, but this Direct Money Market account offers you a debit card for easy account access as well as unlimited transactions and no withdrawal fees. Money markets offer more flexibility and usually come with a higher rate than most savings products.

How many transactions can I do a month? Unlimited. While other banks may charge fees for excess withdrawals, we do not.

What is APY? APY stands for annual percentage yield, which is the total interest earned in one year, including compound interest. Higher APY = more earnings!

How often is interest paid on this account? Interest compounds daily and is credited monthly — meaning the longer you leave your money in the account, the more that interest will compound, so there is a lot of earning potential.

*The Annual Percentage Yield (APY) is accurate as of 6/27/2024. Rates subject to change at any time. Minimum daily balance of $2500 must be maintained to earn interest. $2500 opening deposit required. This Direct Money Market and APY disclosed is only available in select states. Enter your zip code to determine eligibility. Fees may reduce earnings.

**ATM usage fee at non-Union Bank ATMs waived. Non-UBT ATM owners may apply an ATM surcharge fee on transactions at their ATMs. Up to $20 in ATM surcharge fees will be waived per statement cycle.