Better together: financial planning and investing

Financial planning and investing are two important aspects of managing your finances, but they serve different purposes and involve different strategies. If you think of them as complementary to each other, but each equally important to your financial goals, you’ll be on the right track. Let’s discuss how they can fit together to secure your financial future.

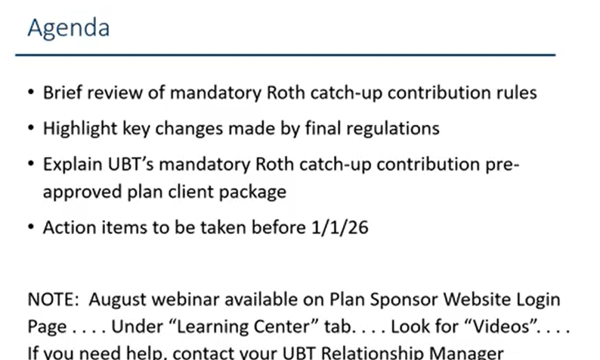

What is financial planning?

Financial planning is the process of setting financial goals and crafting a plan to achieve them. It involves assessing your current financial situation, identifying your short-term and long-term goals, and creating a plan to reach those goals. This plan may include budgeting, saving, managing debt, and protecting yourself and your assets through insurance. Financial planning considers your income, expenses, assets, liabilities, and risk tolerance to create a comprehensive strategy that aligns with your goals and values.

At UBT, our financial planning process starts with a thorough review with one of our friendly advisors, who meets with you to discuss your goals for the future, essentially meeting you where you are to assess how to help you progress strategically toward achieving those goals. Advanced financial planning would include tax and estate planning.

What is investing?

On the other hand, investing is allocating your money to different assets with the expectation of generating a return. It involves purchasing assets such as stocks, bonds, or mutual funds with the goal of increasing your wealth over time. Investing requires careful analysis of various factors, including the risk and return potential of different investments, diversification to manage risk, and understanding market trends and economic conditions.

How do they work together?

While financial planning focuses on the overall management of your finances and achieving your goals, investing is a specific strategy within that broader framework. Financial planning helps you determine how much money you can allocate toward investing, considering your financial goals, risk tolerance, and time horizon. It also helps you assess your progress toward your goals and adjust as needed.

It’s important to note that financial planning and investing are not mutually exclusive; they go hand in hand. A well-designed financial plan incorporates investment strategies that align with your goals and risk tolerance. Investing can help you grow your wealth and achieve your financial goals, but it should be done within the context of a comprehensive financial plan.

Financial planning provides the foundation for making informed decisions about how to allocate your resources, while investing allows you to grow your wealth over time. Combining these two approaches can create a solid financial strategy that helps you achieve your goals and secure your financial future.

How to get started

Wherever you want to be, we have people to help you get there. Our UIMG financial advisors are well-versed in analyzing where you are now, assessing where you’d like to be in the future, and helping you establish a plan to get there. They’re available to answer your questions and keep you informed and can conduct periodic reviews to monitor your progress and keep you on track.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.