Market Recap: March 2024

Market commentary

- The most recent inflation readings were in line with consensus and down from prior month numbers, reinforcing the view that inflation has peaked and will continue to trend downward, with some bumps likely along the way.

- The final fourth-quarter GDP number was revised upward from 3.2% to 3.4% with more tempered expectations going forward.

- The timing of rate cuts has become less important as the economy continues to be resilient and a soft landing is now the consensus view.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 3.4% | 4.9% |

| Consumer Confidence | 104.7 | 104.8 |

| Consumer Price Index Y/Y | 3.2% | 3.1% |

| Core PCE (x food & energy) | 2.8% | 2.9% |

| ISM Manufacturing Index | 50.3 | 47.8 |

| Unemployment Rate | 3.9% | 3.7% |

| 2-Year Treasury Yield | 4.62% | 4.62% |

| 10-Year Treasury Yield | 4.20% | 4.25% |

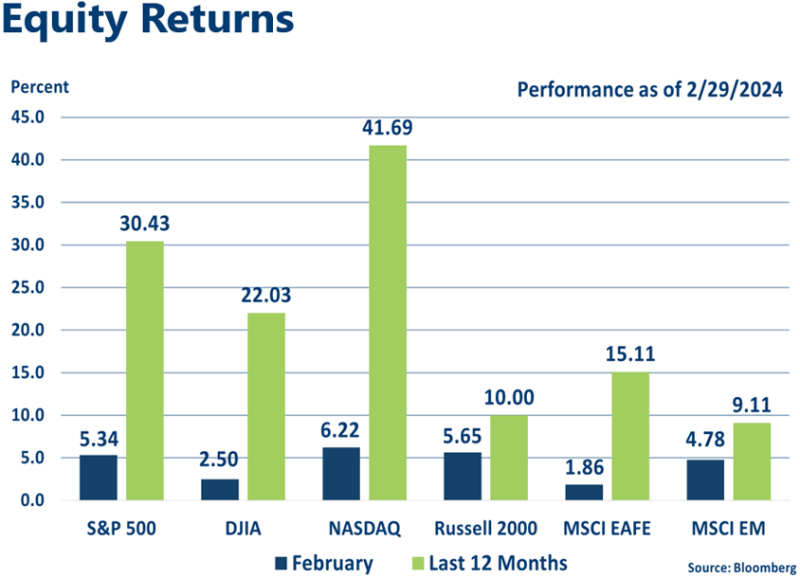

Equities

- The S&P 500 hit 21 record highs in the first quarter and is up 10% YTD, the best first quarter performance in five years.

- March 23 marked the fourth anniversary of the COVID-era low, with the S&P 500 returning an annualized 26% since.

- Equity performance has broadened out with all sectors but real estate rising in the first quarter.

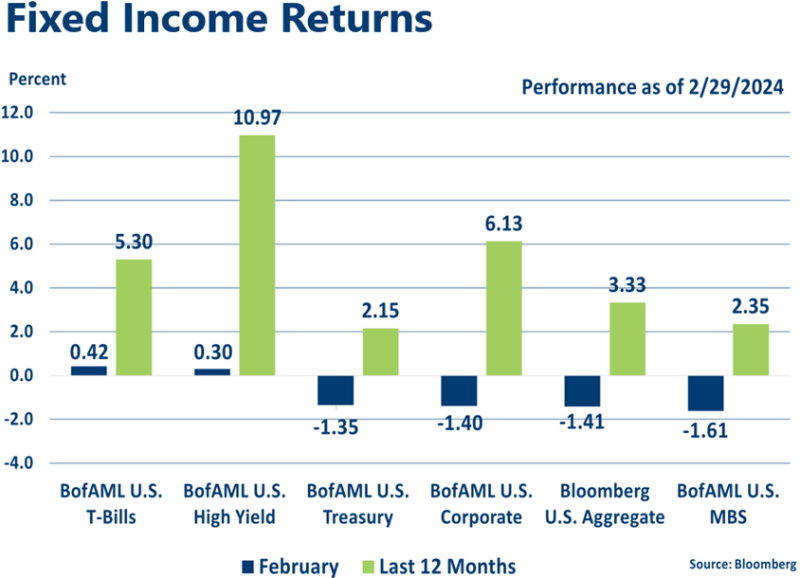

Fixed income

- Bond market returns were positive as rates declined on dovish Fed comments.

- The 2/10 yield curve has been inverted since early July 2022, surpassing the previous record of 624 days set in 1978.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in high-growth large cap stocks after recent rally; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

- Near-average expected returns projected for fixed income after period of rising rates and bond market sell‐off.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.