Market Recap: November 2025

Market commentary

- The government shutdown has ended, but its impact lingers as key economic reports remain delayed.

- Private reports show that consumer confidence fell sharply to a 7-month low while the ISM Manufacturing Index also declined.

- Current forecasts call for GDP to expand at an annualized 2.8% in the third quarter, followed by a deceleration to roughly 1.2% in the fourth quarter.

- Payrolls rose 119k in September, but upward unemployment (4.4%), weak wages, and temp job cuts signal a cyclical slowdown in hiring despite steady jobless claims.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | Delayed | 3.8% |

| Consumer Confidence | 88.7 | 95.5 |

| Consumer Price Index Y/Y | 3.0% | 2.9% |

| Core PCE (x food & energy) | Delayed | 2.9% |

| ISM Manufacturing Index | 48.2 | 48.7 |

| Unemployment Rate | 4.4% | 4.3% |

| 2-Year Treasury Yield | 3.49% | 3.58% |

| 10-Year Treasury Yield | 4.02% | 4.08% |

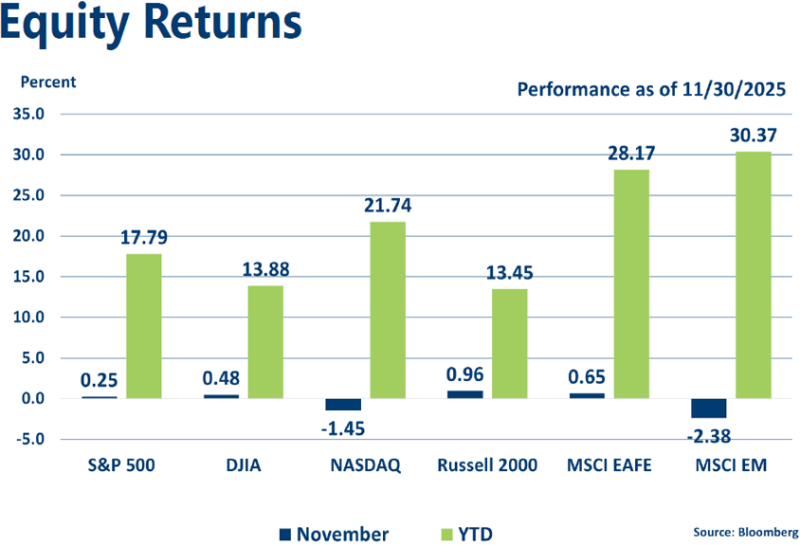

Equities

- As of November 20, the S&P 500 was down 4.4% for the month, but a late five-day rally secured its seventh consecutive monthly gain. Meanwhile, a tech slump pushed the NASDAQ into its first monthly decline since March.

- Eight of the S&P 500’s 11 sectors posted gains, but performance varied widely. Health Care (+9.3%) and Communication Services (+6.4%) led the pack, while Technology (-4.3%) and Consumer Discretionary (-2.4%) lagged.

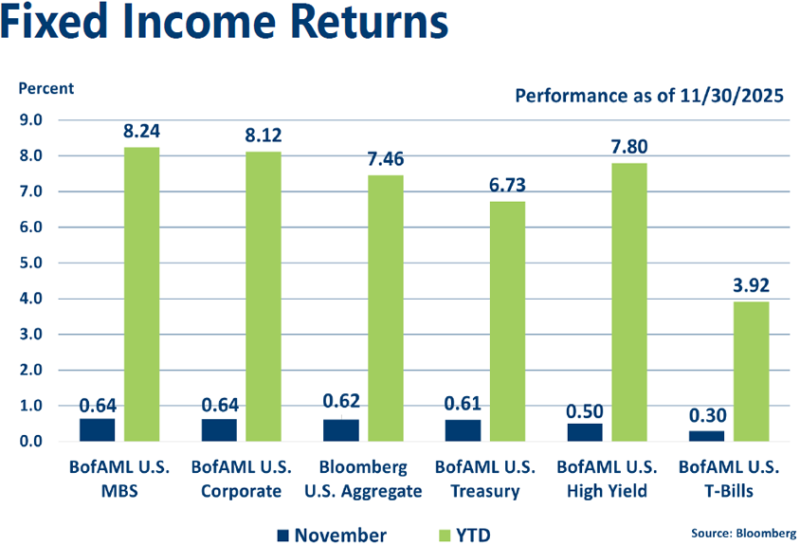

Fixed income

- The Fed lowered rates by 25 bps in both September and October, and expectations for another cut in December continue to build.

- Bond yields continued to fall, while corporate credit spreads stayed near historic lows, resulting in another strong month for fixed-income returns.

Strategic outlook

- Some caution is warranted on equities in the near term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns are projected for fixed income with the Fed on pause and rates reflective of conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.