Mobile wallet FAQs

We tackle some burning questions about how to make the most of mobile wallets.

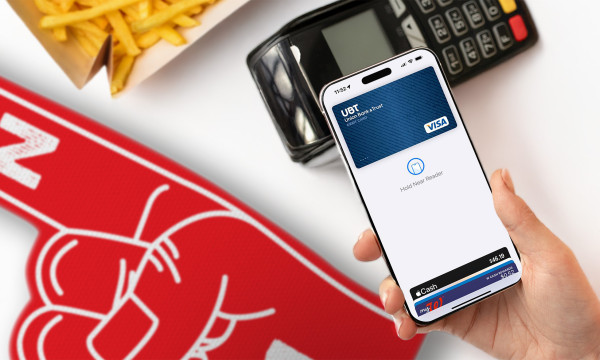

So, you’ve grown quite attached to your debit card — and that’s good! It comes in handy for all sorts of things, from that quick cup of joe to charitable contributions. Paying with your card makes it easy to track your purchases for budgeting purposes, too — the transactions are all right there in your account statement or in your account activity within UBTgo. But we have to ask: Do you keep your card in a wallet wallet or a mobile wallet? If you’re still carrying your card in a regular wallet, chances are you have a few more questions about mobile wallets before you’re ready to make the switch, and we’re happy to oblige! Read on for answers to some of the more frequently asked questions.

What is a mobile wallet, again?

A mobile wallet, just as a refresher for those fairly new to the concept, lives on your mobile device. More specifically, it’s an app on your mobile device that stores payment information from your debit card so you can use that device to make purchases.

Sounds complicated… is it hard to use?

Not at all. There are several different mobile wallets that are compatible with specific devices, which you simply download onto your device; easier yet, your device most likely came with a pre-loaded option. Then, you load your debit card information onto the app, which can be as easy as taking a picture of the card. You then use your mobile wallet to pay for goods and services online and at retailers that accept your device as a payment method. Once the app is installed and the information is entered, the wallet stores this info by assigning a personal identification format such as a number, QR code, key, or image to each stored card.

Are mobile wallets safe?

Yes! Storing your card in a mobile wallet offers better protection than simply swiping, for a few reasons. You won’t be typing in (or storing) your information in merchants’ sites online, which reduces the risk of fraud. And when you’re shopping or dining out, your phone carefully encrypts your payment information, so your debit card is never physically vulnerable. A mobile wallet also provides greater defenses against theft. If you lose your phone, a thief would have to be able to unlock the phone and then pass authentication in the mobile wallet. Mobile wallets with biometric ID, such as a fingerprint scanner, make it nearly impossible for anyone other than you to authorize a transaction on your device.

Are there other benefits?

Using a mobile wallet offers a safer, contact-free form of payment at a time when we are all reducing contact. It’s quicker than traditional payment methods, too. Payment is seamless and relatively hassle-free, as your debit card and other information is all stored in one place. Online or out and about, all you need is your device.

We hope we have answered your top mobile wallet questions. Using one can really provide peace of mind. It keeps your debit card information safe, encrypted, and away from prying eyes, and it offers seamless, contact-free payment when you’re on the go; plus, since we’re rarely without our phones, you’ll always have a form of payment with you!

Have you added your UBT debit card to your smartphone’s mobile wallet yet? Using your mobile wallet is a fast, simple, secure way to pay for goods and services.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.