As one chapter closes at UBT, another begins

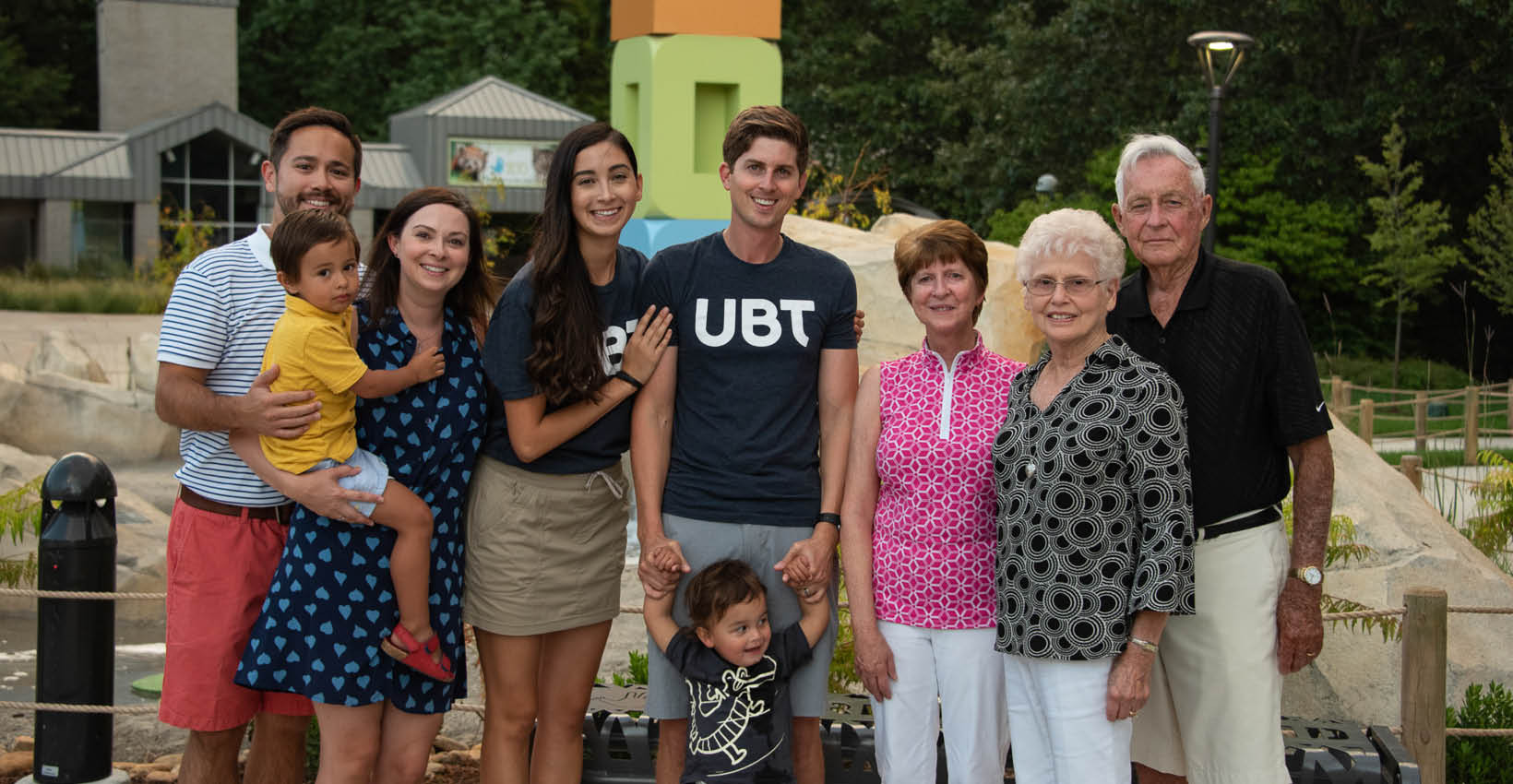

Last year was a big year for UBT. In addition to the grand opening of two exciting new locations (our 144th & Dodge branch in West Omaha and our new downtown home at Union Bank Place in Lincoln), we had one other major — and bittersweet — milestone to celebrate at the end of 2023: Angie Muhleisen, our President and CEO, retired after more than 40 years at Union Bank & Trust. As of January 1, 2024, Angie’s son and Executive Vice President Jason Muhleisen officially stepped into the role as UBT’s new President and CEO.

A legacy to be proud of

Angie has been a constant at UBT for decades, guiding the organization through the ups and downs of the Farm Crisis in the ‘80s, the dot-com bubble in the early 2000s, 2008’s Great Recession, and the unprecedented COVID-19 pandemic, just to name a few. Through it all, she worked hard to keep the bank both safe and competitive, helped to grow bank assets from $50 million to over $8 billion (not to mention $46 billion in trust assets), implemented new technology, and protected the company’s culture.

That last one — culture — is the secret to UBT’s success, if you ask Angie. In the farewell comments she sent out to the bank’s 1,000+ associates, Angie reflected on what makes UBT such a wonderful organization. “The major tenets of our culture are caring about each other, our customers, and the communities we serve,” she wrote. “We know what it means to genuinely care and to be servant leaders. Many organizations lose their way because they have forgotten that we all are human beings and just want to be treated with dignity and respect.” But not UBT: “Our culture is built knowing that people are the most important component to success.”

Sharing her business acumen, making nimble and opportunistic investments, surrounding herself with good people, and giving them the tools and support they need to thrive is how Angie ran UBT every day. And when it came time to start planning for the bank’s future, she was just as strategic with her approach as her father, Jay Dunlap, had been back in the ‘90s prior to Angie stepping into the President and CEO role.

Succession planning with intention

When Jay Dunlap stepped down, Angie knew she had big shoes to fill. “My father is a salt-of-the-earth kind of person,” Angie said. “He is genuine, and he has a great sense of humor. People are naturally drawn to him, and when he walks into a room, he lights up the room. Literally years after he had stepped down as CEO, people at the bank would comment on his days as the CEO.”

To be honest, Jay was surprised that Angie was even interested in following in his footsteps at UBT. But when she wrote him a letter asking for the opportunity to work at the bank, he immediately said yes and began to put her through her paces. Angie worked her way up through the bank over the course of 15 years before eventually taking over as President and CEO. During that time, she absorbed as much knowledge as she could, putting in long hours in different parts of the bank and building relationships with her fellow associates at all levels, including previous President Ross Wilcox and the rest of the brilliant people who made up the bank’s Executive Committee. And that’s exactly the path Angie has taken with preparing her son Jason for his new role. “I only wanted Jason working at the bank if he had a passion for banking,” Angie said. “He had to prove himself just like anyone else would need to.”

To that end, Jason has spent nearly 10 years learning about and undergoing training in all major areas of the bank, with extensive testing at the end of his time in each department. He has worked hard to establish and nurture relationships across the organization, including meeting with the Executive Committee for regular mentorship and guidance, learning from other key leaders throughout the bank, and honing his own leadership style. He looks forward to continuing to learn from and lean on the Executive Committee and the Management Committee as he forges his own path as head of UBT. And as Jay did for Angie, Angie will step out of the day-to-day management of UBT, and will continue to offer advice and guidance by serving as a member of the Executive Committee and on the UBT Board of Directors.

“Our current executive team is talented in so many ways,” Jason said. “They are all honest, loyal, humble, team-oriented, they think strategically, and they always have the bank’s best interests in mind…. Leaders like this and those throughout the bank are what makes me so confident that UBT will continue to be successful in the future.”

The third generation takes the lead

So what does Jason envision for the future? As he begins the first year of his tenure as President and CEO of Union Bank & Trust, several priorities are at the top of his list. “Clearly, digital transformation will continue to evolve in the banking industry,” he said, citing the bank’s ongoing investment in developing digital efficiencies for both customers and employees alike. He also aims to continue the organization’s focus on diversification and customer service.

“Our focus has and will always be on our customers,” Jason said. “As banking changes, we will continue to be innovative and nimble to make sure our customers’ banking needs are met and that they have the best experience working with our team. That will never change.”

As for the culture that has been at the center of the organization since his grandfather was in charge, Jason is up to the challenge of carrying the torch. “My hope for the bank’s culture is that people feel accepted at UBT, they feel fulfillment in their work, and they are happy to work here,” he said. “If we have happy employees and happy customers, success follows.”

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.