SECURE 2.0 brings plan changes in 2024

SECURE 2.0, passed into law in December 2022 as part of the Consolidated Appropriations Act 2023, made many changes to the retirement plan landscape, many of which will go into effect in 2024. In this article, we’ll walk you through some of the updates that are of the most interest to employers sponsoring defined contribution plans.

Key updates for Roth catch-ups and long-term part-time employees

Before we get into SECURE 2.0’s 2024 provisions, there are a couple of key things to note about mandatory Roth catch-up contributions, as well as rules for long-term part-time employees. Here’s what you need to know:

- Mandatory Roth catch-up contributions for higher-paid participants are delayed until 2026. SECURE 2.0 requires that age 50 catch-up contributions made to a 401(k), 403(b), or governmental 457(b) plan must be made on a Roth basis if a participant makes more than $145,000 in FICA wages (amount will be indexed in future years). This rule was initially set to be effective January 1, 2024, but IRS Notice 2023-62 essentially delayed the mandatory catch-up contribution rule until 2026.

- Long-term part-time employees must participate in elective deferral portion of 401(k) plan in 2024. As part of the original SECURE Act, a long-term part-time employee (LTPTE) must be allowed to participate in the elective deferral portion of a 401(k) plan effective in 2024. An LTPTE is an employee who is credited with at least 500 hours of service in three consecutive years. If your plan requires a participant to complete more than 500 hours of service in a year to participate in the elective deferral portion of the plan, please contact your Union Bank Relationship Manager to determine how the LTPTE rule will affect your plan.

SECURE 2.0 provisions effective in 2024

There are several provisions going into effect in 2024 as per SECURE 2.0 guidance; although this is not an exhaustive list, here are the high points that you’ll want to take note of:

- Roth account exemption from lifetime required minimum distributions (RMDs). A participant who has reached their required beginning date must receive RMDs during their lifetime from both pre-tax and Roth accounts. Beginning in 2024, lifetime RMDs will not be required from Roth accounts. Participants will still need to receive lifetime RMDs from pre-tax accounts.

- Matching contributions on student loan payments. An employer may, but is not required to, make matching contributions on qualified student loan payments (QSLPs). If the employer adopts this feature, and a participant makes QSLPs instead of elective deferrals, the employer will be required to make a matching contribution based on the QSLPs.

In adopting this feature, a participant’s right to receive a matching contribution on QSLPs is the same as their right to receive a matching contribution on elective deferrals. For example, if a participant who makes QSLPs instead of elective deferrals has met the eligibility requirements and allocation conditions to receive a matching contribution, then they must receive a matching contribution based on the QSLPs in the same amount as if the participant had made elective deferrals.

- Emergency savings accounts. Employers may allow participants to maintain an emergency savings account inside the plan, funded with Roth contributions. Some of the new rules for savings accounts include the following: (a) savings accounts are only available to non-highly compensated employees; (b) there is a maximum cumulative contribution limit of $2,500 (or lower limit set by the plan); (c) savings accounts must be invested in a stable value, money market, or similar fund; (d) plans with matching contributions must make matching contributions on the savings account contributions; (e) participants must be able to receive a distribution from the savings account at least once per month; and (f) distribution fees cannot be charged on the first four distributions per year.

- Increase in mandatory distribution amount for plans with $5,000 cash-out limit. For those plans with a $5,000 cash-out limit, the limit will be increased to $7,000. Accordingly, beginning in 2024, if a participant who has an account balance between $1,000 and $7,000 does not make a timely distribution election, then their account balance will be distributed to an automatic rollover IRA.

- Emergency expense distributions. SECURE 2.0 provides for a new “emergency expense” distributable event, which is different from the emergency savings accounts addressed above and is designed to allow a participant to pay for unforeseeable personal or family emergency expenses using plan dollars. The following rules apply to emergency expense distributions: (a) the 10% early distribution penalty will not apply; (b) the distribution cannot exceed the lesser of $1,000 or the amount by which the participant’s account exceeds $1,000; (c) a participant can self-certify that they have incurred an emergency expense; (d) a participant cannot receive an emergency expense distribution for three years after the year in which an earlier emergency expense distribution was made unless the participant repays the previous emergency expense distribution to the Plan (or makes elective deferrals in an amount at least equal to the distribution); and (e) a participant can repay an emergency expense distribution to the plan within three years.

- Domestic abuse distributions. SECURE 2.0 allows a participant to request a domestic abuse distribution up to one year after they experience domestic abuse by a spouse or domestic partner. The distribution amount cannot exceed the lesser of $10,000 (indexed after 2024) or 50% of the participant’s vested account balance. The distribution will not be subject to the early distribution penalty and can be repaid to the plan within three years. A participant can self-certify as to the abuse.

Operational compliance document

Although plans do not need to be amended for SECURE 2.0 until 2025, plans must operationally comply with the law before the 2025 amendment. Accordingly, later this year, we will provide employers with an “operational compliance” document that explains which SECURE 2.0 2024 provisions will be implemented.

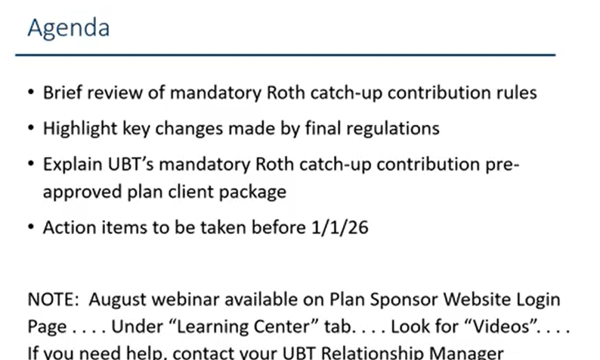

Union Bank client webinar

Your friends at Union Bank will be presenting a client webinar called “SECURE 2.0 Provisions Effective in 2024” on Thursday, November 2, at 10 a.m. CDT. The one-hour webinar will address SECURE 2.0’s 2024 provisions, incorporating any IRS or DOL guidance issued before then. Watch your email for additional information and a registration link for this event.

If you have any questions about SECURE 2.0, the latest updates, or how these changes may affect your company’s plan, please don’t hesitate to reach out to your Relationship Manager and we will be happy to help.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.