UBTgo services

We’ve designed our online banking, mobile banking, and alerts to help you keep an eye on your accounts — so you can avoid overdraft fees.

Automatic fund transfers

Automatically transfer funds from another UBT deposit account.

Checking Plus

A line of credit that offers protection against overdrafts and a source of funds for larger purchases or emergencies.

Overdraft Privilege

Rather than automatically returning any insufficient fund items you may have, we will consider payment of your reasonable overdrafts.

| Overdraft Prevention | Overdraft Protection Options | Overdraft Privilege Options | |||

| Product | UBTgo services, including online banking, alerts, and mobile banking | Automatic funds transfer | Checking Plus | Standard Overdraft Privilege | Overdraft Privilege With Optional Debit Card Overdraft Privilege |

| Details | Prevent overdrafts by keeping an eye on your account using our digital tools. | Automatically transfer funds from another UBT deposit account. | A line of credit that offers protection against overdrafts and acts as a source of funds for larger purchases or emergencies. Subject to credit approval. | Rather than automatically returning any insufficient fund items that you may have, we will consider, without obligation on our part, payment of your reasonable overdrafts. | For accounts with Standard Overdraft Privilege, you have the option to authorize us to also consider, without obligation on our part, payment of your overdrafts on ATM and everyday debit card transactions. |

| Fees and Costs | Message and data rates may apply. | Free | $34 annual fee and 18.00% Annual Percentage Rate calculated from the date you access funds from the line of credit. Repayment is easy with an automatic charge of 1/20th of the outstanding balance ($15 minimum), plus interest. Or, you can pay the entire balance at any time. |

$34 NSF Paid or Returned Item Fee (maximum of 5 per day). $25 Continuous Overdraft Fee will be charged every 5th consecutive business day the account remains in overdraft status. |

$34 NSF Paid or Returned Item Fee (maximum of 5 per day). $25 Continuous Overdraft Fee will be charged every 5th consecutive business day the account remains in overdraft status. |

| Exceptions | If funds available for transfer do not sufficiently cover the amount of overdraft, the Applicable Fees as described in the Overdraft Privilege Service Description will apply. | If funds available for transfer do not sufficiently cover the amount of overdraft, the Applicable Fees as described in the Overdraft Privilege Service Description will apply. | See the Overdraft Privilege Service Description. | See the Overdraft Privilege Service Description. | |

| Transfer Increments | Not applicable | Funds are automatically transferred from another checking or savings account in $100 increments up to the amount of funds available for transfer. | Automatically advances funds into your checking account in increments of $200, up to your approved credit limit. | Not applicable | Not applicable |

| Does my coverage include ATM and debit card transactions? | Not applicable | Yes | Yes | For personal accounts, only if you authorize us. See below for more details and the column to the right. This coverage is included for applicable business accounts. | Yes |

| How do I enroll? | Enroll online. | Sign up in a branch or call Customer Support at 800.297.2837. | Apply at any branch location or call 888.828.4450. | This service is automatically available to customers who maintain their checking account in good standing. | Review the information and fill out this authorization form. |

| Can I cancel? | You may cancel at anytime. | You may cancel anytime. Stop by a branch or call Customer Support at 800.297.2837. | You may cancel anytime. Stop by a branch or call Customer Support at 800.297.2837. | You may cancel Overdraft Privilege Service by stopping by any of our branch locations or calling Customer Support at 800.297.2837. | You may cancel Debit Card Overdraft Privilege by stopping by any of our branch locations, calling Customer Support at 800.297.2837, or by using the online opt out form. |

Overdraft Protection

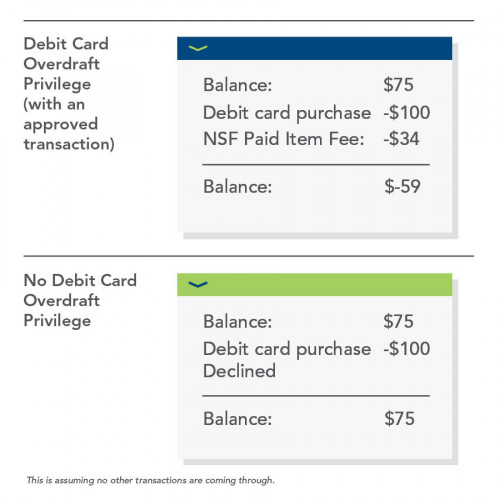

Debit Card Overdraft Privilege

You have two options for your ATM and everyday debit card transactions in the case of an overdraft. One option allows your debit card to work (at our discretion) even if you spend more than what’s in your account, which will incur an NSF Paid Item fee for each item paid into overdraft. Or you can choose for your debit card to be declined, without an NSF Item fee, when you do not have enough money in your account to cover the purchase.