Avoid overdrafts using alerts in UBTgo

How much money do I have in my account? That can be scary question for a lot of people; almost everyone has held their breath at the thought at least once.

Checking your account balance can be overwhelming, but it doesn’t have to be. Setting up alerts that notify you about your account activity can help alleviate stress and reduce overdraft fees — and who wouldn’t feel relief at that kind of support?

UBTgo alerts proactively alert you about specific activity on your account. Alert options vary by bank; at UBT, we offer a variety of alert types based on your account and your goal for managing your money. There are two alerts that we recommend for helping you keep tabs on your account and take action if you balance dips too low.

The Balance Alert

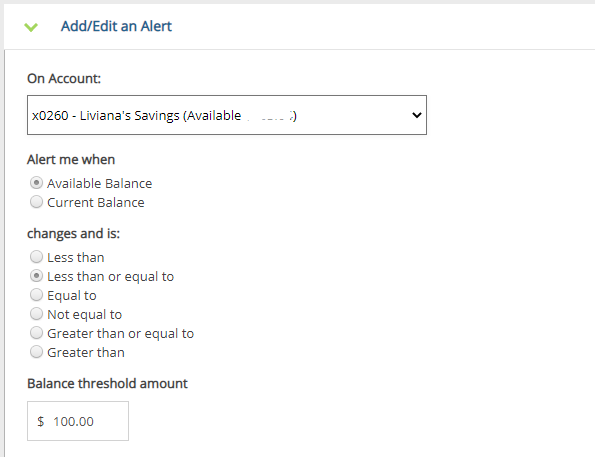

When setting up a Balance Alert within your UBTgo profile, you have the ability to customize the balance parameters, offering you the flexibility to determine when an alert should be generated. Here a few tips to help you set up a helpful low-balance alert.

- Select the account you want to be notified about.

- Select the balance type. For avoiding overdrafts, we recommend selecting the Available Balance option. The available balance changes throughout the day, so you’ll be notified shortly after it changes and have a better chance of receiving the alert in time to make a deposit before the end of the business day. (Current Balance is an end-of-business-day balance. By the time you receive a Current Balance alert, it’s likely too late to take action.)

- Select “less than or equal to.”

- Choose an amount. We recommend selecting an amount greater than $0 so that you’re notified before your account hits zero.

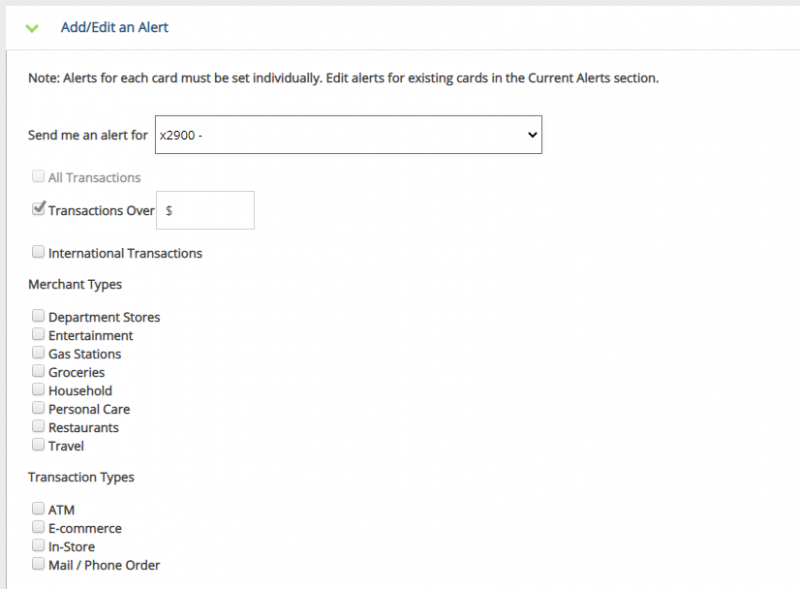

The Card Alert

Setting up Card Alerts allows you to be notified whenever your debit card is used. When you set a Card Alert, it can be customized so that you don’t receive an alert for every debit card transaction (unless that’s an option you want) but rather for those transactions over a certain dollar limit, to specific merchant types, or even for certain transaction types.

What’s even better is that you can set up your alerts to be received by text, email, or both, and you can even have multiple alerts in place. You are unique, and so is your spending, so customization to fit your financial lifestyle is key to setting alerts that work for you. Who needs the headache of wondering what’s going on in your account?

Hopefully these two alert types will help you to keep better tabs on your money. Need assistance with alerts? Connect with our Customer Support Team, where our Specialists would be happy to assist.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.