Is it smart to leave funds in P2P platforms?

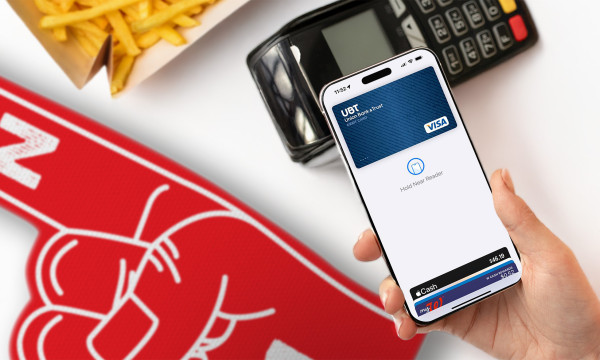

Peer-to-peer (P2P) platforms like Venmo® and Cash App® have never been more popular — and with good reason! They make it extremely easy to settle your IOUs, shop the farmers market, even collect from your roommate. They make it so easy, in fact, you might just be tempted to use it like a bank account, or even an investment account, since there’s a cryptocurrency option. While these platforms offer convenience and ease of use, there are several reasons why treating them as long-term holding accounts may not be the best choice — and why they might not be the optimal investment option, either. Let’s take a look at these reasons why P2P platforms are best left to their original purpose. We’ll also discuss some possible alternatives.

Limited protection — and assistance

P2P platforms are designed for quick and easy money transfers between individuals — period. They’re not intended to function as a full-fledged checking or savings account, and these apps aren’t automatically protected by insurance to cover your money, the way a bank would be protected by FDIC insurance. Think of it this way: An entity that isn’t a real bank is holding your real money, without FDIC protection or real, caring people to help you out if something goes wrong.

Try to keep only what you need to transfer in your P2P account. There’s no need to pay an extra fee to transfer funds immediately, but it’s best to make the transfer to your actual bank account as soon as possible, and keep tabs on your money’s coming and goings. And regardless of the platform you choose, always be sure that you know (and verify!) exactly who you’re sending money to and that you enter the information carefully, because once your money’s gone, it’s likely gone for good.

Delayed access to funds

With a P2P platform, you have to wait for your money. P2P platforms usually state that it will be a couple days before you have access to your funds, but warn that reviews may cause delays. During such a review, suspected fraudulent activity or violations of their terms of service could result in funds being blocked or frozen, leaving your money in limbo (and you in a financial bind).

Again, by keeping only the necessary funds in your P2P accounts, you can minimize the impact of an unexpected delay. Make sure you understand the user agreement of the payment platform you’re using and that you personally know the individual you’re purchasing online goods or services from. This isn’t the platform to use to score concert tickets or sneakers from a stranger. It may get flagged as a scam — and it could be.

Your money doesn’t draw interest

Even though your Venmo® or Cash App® account kind of behaves like mobile banking, with the ability to view transactions and all, it doesn’t put your money to work for you like an actual account would. No matter how long it sits there, your dough doesn’t earn you one cent. And the crypto option? There’s likely a per-transaction fee and limited support.

A smart alternative to letting funds sit stagnant would be to move excess funds into a savings account or interest-bearing checking account (we happen to know of a couple of great ones) so that the balance is making money. As far as investments go, you’ll want to do your research first and be aware of the number of transactions you’re making and the fees attached. One other option to consider is an Online Investing platform such as UBT’s. It’s a great way to dip your toe in investing* with friendly, knowledgeable support nearby.

P2P has its place — but do your due diligence

There’s no need to give up on quick and convenient money transfers; we know how easy they make splitting a lunch tab. However, treating P2P platforms as long-term holding accounts can expose your funds to unnecessary risks as well as missed opportunities. Plus, they usually don’t come with friendly faces who are on hand to help you build your financial foundation. They won’t benefit your credit score, and they won’t help you establish a financial history or a personal relationship with people who can help you through all the stages of your financial life, like buying a car, starting a business, or investing for your future.

When you do use P2P platforms, the best thing you can do is be a savvy consumer. Try making it a priority to withdraw excess funds, leaving only what’s necessary for immediate transactions. It might be easiest to do this with a P2P platform like Zelle® that’s linked to your bank account so that you don’t have to do any of the heavy lifting; it transfers in and out of your account automatically. As for what’s left over, how about letting real people help you with your real money? Your friends at UBT are always here to help! Stop by any branch or contact our Customer Support team if we can tell you about our interest-bearing accounts or answer any questions.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.

Zelle and the Zelle related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Venmo is a registered trademark of PayPal, Inc.

Cash App is a registered trademark of Square, Inc.