Market Recap: December 2025

Market commentary

- U.S. real GDP grew at 4.3% annualized in Q3 2025, the fastest in two years, with fourth quarter GDP tracking near 3.0% growth despite prior government shutdowns.

- The Federal Reserve cut interest rates by 0.25% on December 10, its third reduction in 2025, and now appears close to a neutral policy stance.

- Consumer spending continues to drive GDP growth, maintaining an upward trend despite 2025 tariff-related volatility, supported by strong employment, 4% wage gains, credit availability, and solid holiday sales.

- Credit card balances and “buy now, pay later” programs are rising, suggesting some consumers — especially in lower-income groups — are increasingly relying on credit to sustain spending.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 4.3% | 3.8% |

| Consumer Confidence | 89.1 | 92.9 |

| Consumer Price Index Y/Y | 2.7% | 3.0% |

| Core PCE (x food & energy) | 2.8% | 2.9% |

| ISM Manufacturing Index | 48.4 | 48.2 |

| Unemployment Rate | 4.6% | 4.4% |

| 2-Year Treasury Yield | 3.48% | 3.49% |

| 10-Year Treasury Yield | 4.17% | 4.02% |

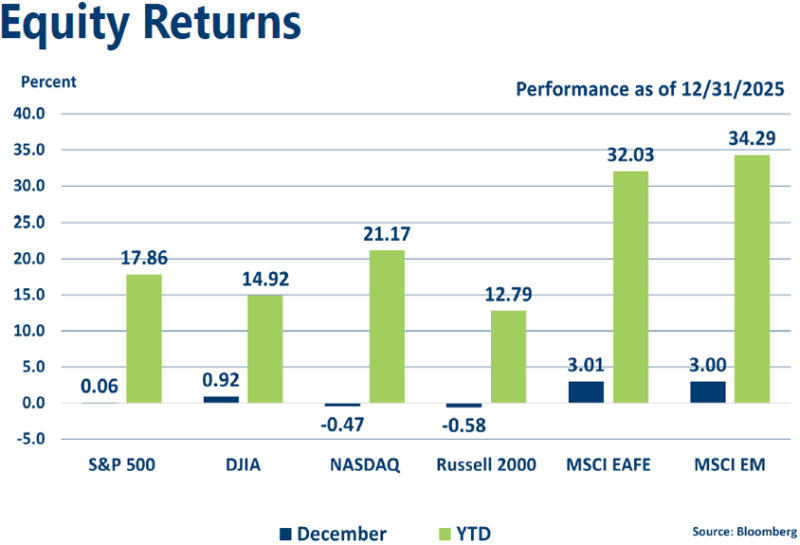

Equities

- Despite modest declines in the Nasdaq and Russell 2000, U.S. stocks held firm in December, ending the year strongly positive for the third consecutive year.

- International stocks continue to benefit from a weakening U.S. dollar, which fell nearly 10% last year versus a basket of global currencies.

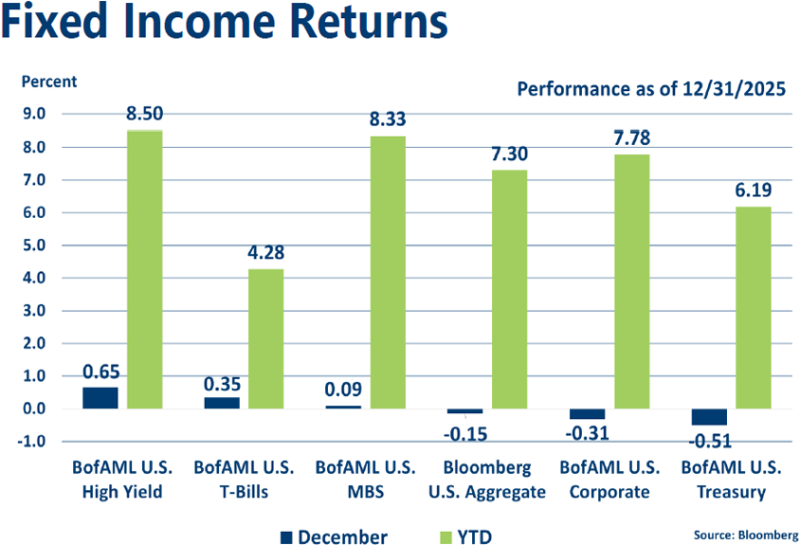

Fixed income

- Although the Fed cut rates, intermediate and long-term yields climbed in December, with 10-year Treasuries reaching 4.17%, reflecting inflation concerns, while money market yields continued to decline.

- Rising rates drove mostly negative returns for longer-duration fixed income indices, while shorter high-yield bonds delivered positive performance.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns projected for fixed income with the Fed on pause and rates reflective of economic conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.