First-Time Homebuyer’s Guide

Step 1: Crunch your numbers

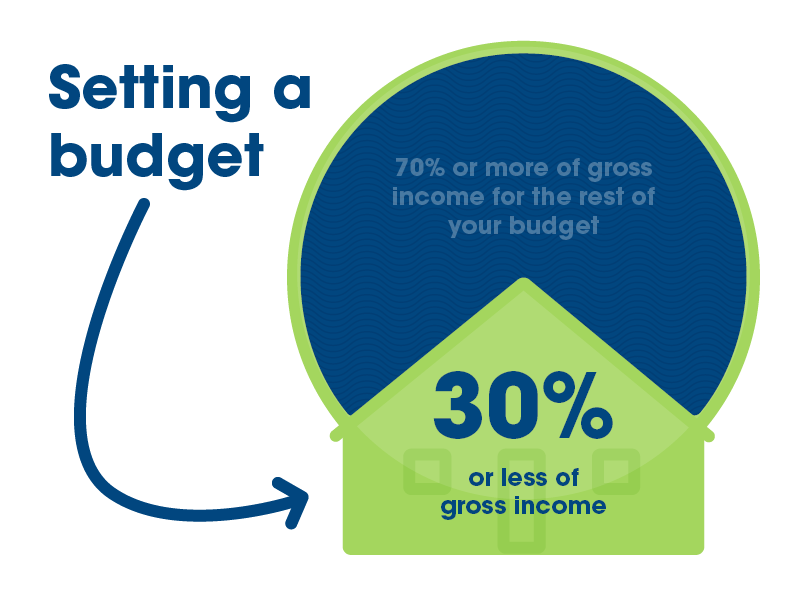

Before you buy a home, you’ll want to start by determining what you can reasonably afford; this preliminary step will give you a jumping-off point for house hunting. You’ll be responsible for the monthly mortgage payments, homeowners insurance, taxes, possible homeowner association fees, and maintenance costs — and real life doesn’t stop because you’ve bought a home, so you’ll still have those everyday expenses that come up. Taking a realistic look at your budget helps you assess what is a comfortable payment amount before moving forward. Pro tip: Lenders typically recommend that consumers’ monthly mortgage expenses not exceed 30% of gross monthly income.

Once you’ve reviewed your budget and looked at your emergency reserves, you may be wondering if you’ve saved enough to be able to afford a home. We have good news: Saving money for your down payment is important, but your purchase may not require nearly the down payment you think. Lenders have different requirements for down payments, and a wide array of loan options are now available, including some that allow for little or no money down at all. Government-backed loan programs with specific qualifying criteria (such as VA) allow for buyers to finance up to 100% of their purchase price. Even without a special program, many first-time buyers are paying as little as 3% down. You’ll want to discuss with your lender how this may impact your payment, however, as we’re still aiming for affordability.

Do some calculations

- Calculate your loan payment by talking with your lender or using a mortgage calculator like this one from Zillow to get an idea of your fixed-rate payments.

- Keep in mind that your total monthly payment will consist of principal, interest, taxes, insurance (both homeowners and mortgage insurance), and association dues, as applicable. This home loan tool kit from the Consumer Financial Protection Bureau is a great reference.

- Questions about insurance estimates, homeowners insurance, and private mortgage insurance (PMI)? Your lender is a great resource.

Step 2: Get organized

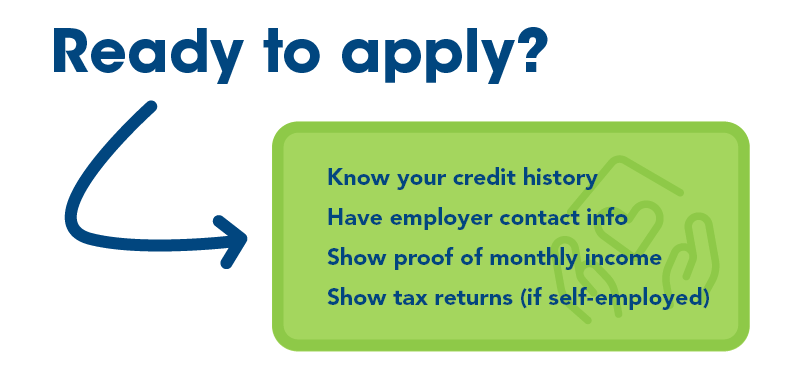

Before you start looking for a home or completing a home loan application, it’s a good idea to gather some key information and documents you’ll need when applying for your loan. Let’s take a closer look at what you may need.

Credit history. You’re entitled to a free credit report once a year, and this is the time to take advantage. Request your report so you can avoid any surprises at the prequalification table, and identify/fix any issues before you buy a home. We recommend using annualcreditreport.com.

Employer details. Gather the names and work phone numbers of any employers you’ve had in the past two years.

Monthly income. It’s wise to have your most recent pay stubs showing year-to-date income, including bonuses, commissions, and overtime for the past two years. If a lot of your income comes from irregular sources such as bonuses, commissions, and overtime, know that most loan programs utilize a calculation for your history of earnings, not just what you earned so far this year. If you receive tip income, you’ll want to grab the last two years’ worth of W-2s. Also, if you’re co-borrowing (with a spouse, for example), you’ll want to gather this information for both parties.

If you’re self-employed, you will need personal tax return documentation for the past two years, and possible additional supporting documents (such as K-1s, business returns, 1099s) pertaining to your income. Your loan officer can review your unique situation and request information accordingly, but it helps to have it at the ready. (Pro tip: Your qualifying income is mostly based on the amount of income you pay taxes on, rather than gross sales or revenue.)

Documentation of additional obligations. Your additional obligations may include payment of child support, alimony, or separate maintenance income. Your monthly obligations for these court-ordered items will be considered, and payment history is checked for timeliness. Be upfront about anything that you pay, including any “informal” personal loans from family, to help avoid surprises during the loan process.

Step 3: Find financing

Once you know your budget, it’s time to find a mortgage specialist and secure a loan. Keep in mind the type of experience you’d like to have, and how accessible your lender is going to be. We recommend going local (may we suggest UBT?) for a personalized home purchase journey from a leading home lender. Look for one that offers a robust prequalification completed by a real person — most realtors and sellers prefer to see offers with prequalification letters from companies they trust to help them feel confident that the sale will go through.

Speaking of getting prequalified, we’d highly recommend it. While a prequalification isn’t a guarantee you’ll be approved, it’s where you will start to turn your research into reality. Together, you and your loan officer will select a loan type tailored to your needs (including down payment and affordability) while giving you the best chance at a winning offer in a competitive market. When you find the house you want to call home, you’ll be able to act quickly and make an offer with confidence. Be sure and ask for clarification on anything that isn’t crystal-clear. Your mortgage specialist wants you to feel as comfortable and informed as possible.

Step 4: Round out your team of trusted professionals

In addition to selecting a loan officer, you will also need a realtor and a homeowners insurance agent. Your lender can help you select providers, but recommendations from friends and family are awesome too!

Realtors are experts at turning your wish list and budget into possibilities, making your home selection process easy. They’ll advocate for you throughout the transaction and help with complexities such as home inspections or requested repairs. Typically, the costs of a realtor are covered by the seller if a home is listed for sale through a company. (If you’re looking at for-sale-by-owner homes, you likely will be covering some of those costs — be sure to check the fine print.)

You will also need a homeowners insurance agent very early in the process after an accepted offer; having someone selected or preparing a list of who/what companies you will contact for homeowners insurance quotes is a good way to get this step out of the way and ensure that your insurance shopping doesn’t cause a delay in mortgage approval. Your lender will have to verify the coverage you’ve selected and will need to speak with your agent.

Step 5: Find your home

This is the fun part! We’d recommend considering these key points to ensure you find a home that truly suits you. As you consider these features, note which ones are truly needs and those on which you’d be willing to compromise; it helps to make a list of priorities before you set out.

- Check out different styles and floor plans (ranch, two-story, etc.)

- Look at various neighborhoods — which ones just feel right to you?

- List priorities inside the home, like number of bedrooms, finished basement, size of kitchen, central heat, or air conditioning

- List priorities outside the home, like size of yard, garage, or landscaping/trees

- Don’t overlook neighborhood priorities, like proximity to schools, entertainment, shopping, police/fire, etc.

You can do the searching on your own, with real estate websites, or with the help of a realtor, who can provide local market expertise and guidance.

Step 6: Make an offer

The next step to buying a home is to make an offer in writing and submit it to the seller. This can be done on your own or through your real estate agent and is accompanied by a deposit. This deposit, called “earnest money,” indicates a serious intent to purchase and is usually a predetermined amount. This deposit is refundable in most cases and will only be charged if your offer is accepted. Be sure to thoroughly understand the stipulations of the money that’s exchanged, as it can vary.

If you are making an offer without the assistance of a realtor, you’ll want to consult a real estate attorney to ensure that you and the seller are complying with your state’s real estate laws, that your contract has been reviewed, and all your questions answered. An offer is a legal contract, and once the seller accepts, you’ve both agreed to the terms outlined.

Above all, we hope you’ll enjoy the home-buying process, with help from your friends at UBT. For assistance, answers, or support, don’t hesitate to reach out. We’re here for you!

Loan products subject to credit approval.