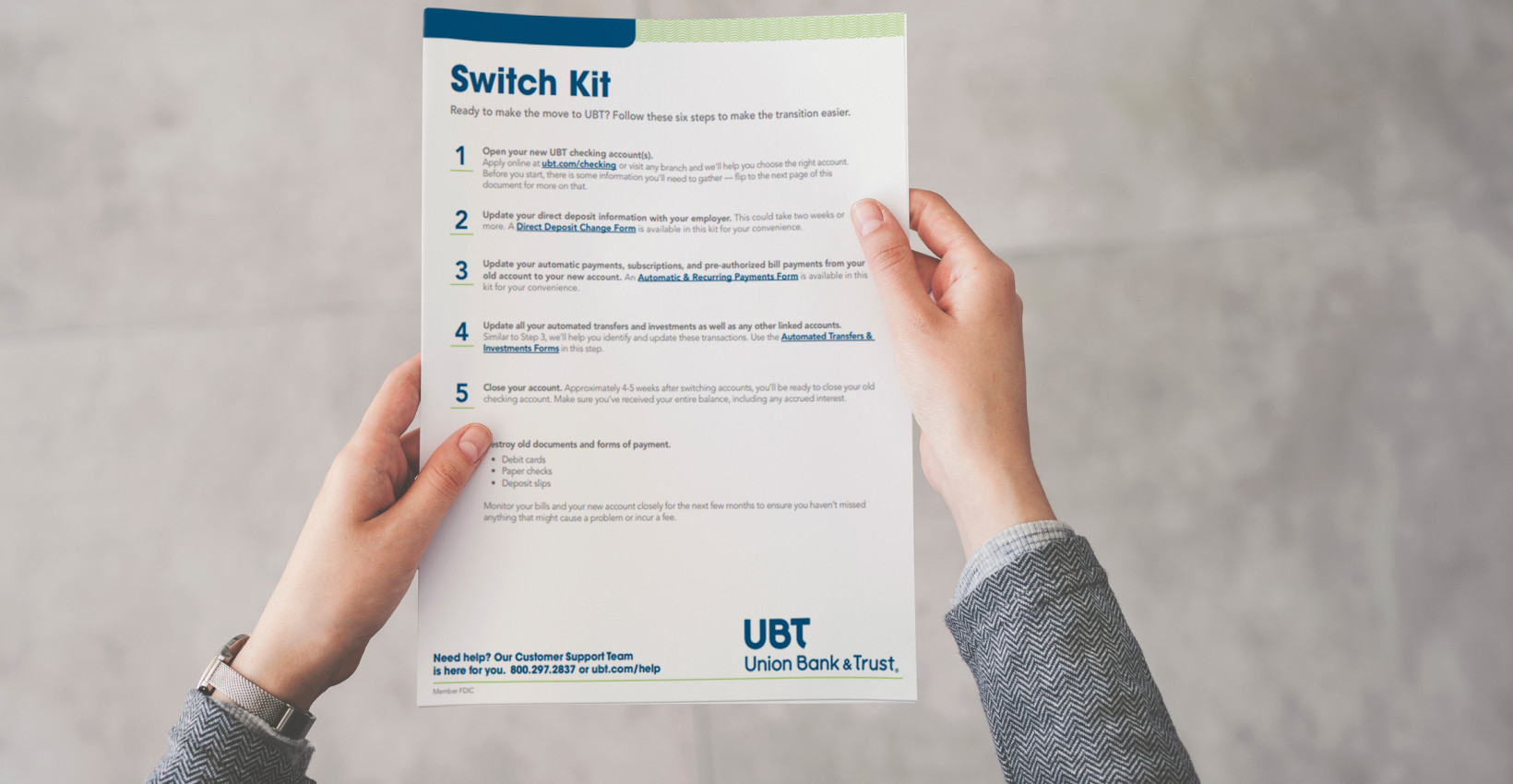

Switch Kit

We understand that changing banks can be a little daunting, so we put together a Switch Kit to help make it as easy as possible. Use our convenient forms and follow these six steps to update your direct deposits, automatic payments, and more.

1. Open your new account.

Ready to open your Union Bank account? Choose the right account for you and apply online here, or visit with a friendly Personal Banker at any UBT location. We’re here to help you with anything you need.

Use these forms to update your direct deposits, automatic payments, and more. The Switch Kit includes forms for:

- Direct deposit change

- Automatic and recurring payments

- Automated transfers and investments

2. Update your direct deposit information.

It’s important to complete this information for your employer and/or the Social Security Administration as soon as you can, as this can take 2-4 weeks to take effect. A Direct Deposit Change Form is available in this kit for your convenience.

3. Update your automatic transactions and subscriptions.

We’ve included a handy form to guide you through identifying automatic transactions connected to your checking account or debit card, including utilities, subscriptions, insurance, and more. This form will help you make sure you think of everything and help you document contacting them should any issues or questions arise.

Direct deposit:

- Your employer’s Human Resources department

- The company handling your retirement or pension payments

- Social Security Administration

Automatic withdrawals:

- Mortgage or rent payments

- Utilities and phone

- Memberships (gym, streaming services, etc.)

- Insurance premium payments

4. Update your automated transfers and investments.

Similar to #3 above, it’s also important to identify, document, and update these transactions to your new checking account and routing number. For example, you may have IRAs or a 529 college savings plan that you automatically move money to each month from your checking account. Or you may do the same with your children’s savings accounts. Whatever those transactions are, we’ve included a handy form to guide you through this, as well.

5. Close your old account.

It’s important to make sure your old account is open long enough to allow outstanding checks and automatic withdrawals to clear or complete. Approximately 4-5 weeks after switching accounts, you’ll be ready to close your old checking account. Make sure you’ve received your entire balance, including any accrued interest.

6. Destroy old documents and forms of payment.

- Debit cards

- Paper checks

- Deposit slips

Monitor your bills and your new account closely for the next few months to ensure you haven’t missed anything that might cause a problem or incur a fee.

That’s it! Thank you for choosing UBT.

We’re going to be great together. If you need anything, contact our Customer Support Team, start a chat, or stop by. We’ll be happy to help.

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.