What’s my balance, anyway?

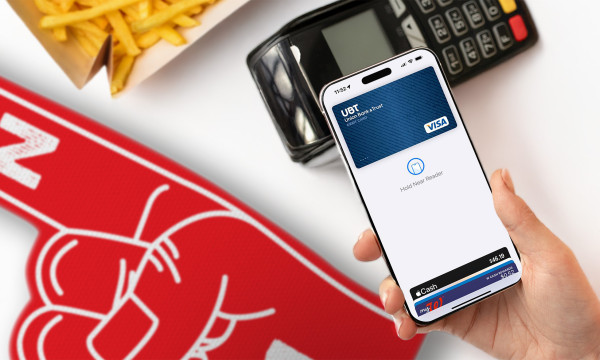

The scenario: You’re about to swipe your debit card for a purchase and decide to check your balance on UBTgo first. Once you get logged in and view your account, you see both pending and posted transactions and current and available balances. So what is the exact amount of money you have on hand to work with?

Let’s do a deep dive into exactly what you’re looking at when you review your account so you can better understand what these items mean to you. There’s a lot of great information in the details — but understanding them is half the battle.

Pending vs. posted transactions

Let’s start with pending and posted transactions. Imagine you’re at a coffee shop, treating yourself to a delicious latte. You whip out your trusty debit card and make the payment. Before you’re even sipping on your vanilla latte with oat milk and a dash of honey, a pending transaction, or an “authorization,” is created. It’s like a little note saying, “Hey UBT, I’m about to take some money from my account, so be ready!”

The authorization allows for the merchant to verify that you’ve got the funds available for that latte. The merchant then holds those funds for a couple of days; you’ll see this authorization reflected in your balance and pending transactions. Within a couple business days, the merchant will release their authorization and collect the actual purchase from your UBT account. Once it’s posted, it becomes a permanent record of that day’s latte indulgence.

A note on PIN-based vs. non-PIN-based (credit) transactions

Many (but not all) merchants allow for you to swipe your card as a debit transaction and input your 4-digit PIN. By selecting this option, you eliminate the need for the merchant to process an authorization and therefore your PIN-based debit card transaction will not go through an authorization phase, but instead will debit your account instantly.

Most notably, did you know that your purchase amount may change after an authorization? Let’s revisit your trip to the coffee shop. You are ready to pay your bill and the barista swipes your debit card, creating an authorization, and hands you your receipt. You add a tip to your receipt and leave a happy customer. So how and when will that tip be reflected in your balance? Your account will immediately reflect the amount that was authorized, or the initial amount listed on your receipt from the coffee shop; let’s say that was $6. You added a generous tip because let’s face it, that vanilla latte with oat milk and a dash of honey was awesome and you feel bad that they had to run to the back for extra oat milk, which brings the total you authorized to $10. Your account will display the $6 “authorization” initiated by the merchant for a couple of business days, but when the merchant collects for the actual purchase, you will see the $10 listed for the transaction; rest assured the $6 authorization will automatically expire and drop off your account.

Available vs. current balances

Think of your available balance as the money you can actually use right now. It’s like the cash in your wallet, ready to be spent. However, this balance doesn’t consider all deposits, depending on how those deposits were made. For example, when you deposit a check written from a different bank or make a deposit using mobile deposit or an ATM, those funds are not able to be immediately verified. Therefore, only a portion of those deposits are made immediately available as cash in your wallet, so to speak. So, while you will see the full amount of those funds displayed in your current balance (the total balance you have in your account), you will only see a portion of those deposits reflected in your available balance (the total balance available to you at that time).

Let’s say you started the day with $100 in your account and after spending $10 for that fancy latte, including tip, you stop by an ATM to deposit a $200 check you received as a birthday gift from your parents. Since your parents do not bank with UBT, those funds cannot be verified immediately, so you only get instant credit for $100. When you log into UBTgo, you will see that your current balance shows $290, while your available balance only shows $190. While this can be alarming, don’t fret! Once the funds from the check you deposited are collected from the other bank, your available balance will update to reflect the full amount of your deposit. This generally occurs the following business day. Not sure what that means in practice? Here’s a cheat sheet of cutoff times for different deposit methods for them to be considered available the next business day:

- 6 p.m. if making a deposit through an ATM (funds credit your account after 10 p.m.)

- 6 p.m. if making a deposit through the mobile deposit feature found within the UBTgo app (funds credit your account after 10 p.m.)

- 7 p.m. if making a deposit at one of our in-store branches

- 9 p.m. if making a deposit through UBTgo as an account-to-account transfer between your UBT accounts

A quick recap

Imagine your bank account as a party. The pending transactions are like your friends who RSVP’d but haven’t shown up yet. You know for sure they will show up, but until they walk through the door, you can’t check off their names on your guest list. The posted transactions, on the other hand, are like the friends who have already arrived and are cutting a rug on the dance floor. They’re here to stay!

As for the available and current balances, think of them as your party budget. The available balance is like the money you’ve set aside specifically for the party. It’s what you can spend without going overboard. The current balance, on the other hand, is like the total amount of money you have, including any pending expenses and deposits. It’s the real deal, the whole shebang! Think of it like a final report on what you spent on the party when all the receipts are reconciled.

So, there you have it! The difference between pending and posted transactions, as well as available and current balances. Now, the next time you check your bank account, you’ll be armed with the knowledge to navigate through those numbers with ease. Happy banking!

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.